Abstract

We analyze Argentina’s macroeconomic policy and performance between 2003 and 2013. The period began with a rapid recovery following the 2001–02 crisis. Recovery then turned into strong and sustained growth. By late 2011, despite a very favorable external context, Argentina entered a stagflationary trap. Facing a visible lack of foreign exchange, the authorities introduced and reinforced a series of controls, which did not prevent a currency crisis in late 2013 and early 2014. We argue that macroeconomic performance during the whole period was closely related to the way macroeconomic policy was conducted. More specifically, we claim that the shift from high growth to stagflation was due to a change in the approach to macroeconomic policy: from one aiming to preserve a stable and competitive real exchange rate and twin surpluses, to another one of populist orientation.

Similar content being viewed by others

INTRODUCTION

This paper analyzes macroeconomic policy and performance in Argentina between 2002 and 2013. This is a very interesting case study. The period began with a severe financial and debt crisis. In December 2001, the government announced the largest default on public debt in global financial history. By mid-2002, GDP was 21% lower than its previous peak of mid-1998, unemployment rate reached almost 22% and half of the population became poor. Rather unexpectedly for most observers, the economy began a rapid and strong recovery, which then turned into rapid and strong economic growth. During this process employment grew very fast, many tradable services, manufactures and agricultural activities boomed and non-traditional exports expanded at a rapid pace. The impact of the global financial crisis of 2008–2009 was short-lived and not as severe as in other emerging markets. However, by late 2011, despite the very favorable external context of low interest rates and high terms of trade, the economy started to be constrained by the lack of foreign exchange. In early 2014, it finally faced a balance of payments crisis that forced the central bank to devalue the peso by 25% in a few days. As a result inflation accelerated and output and employment contracted. On top of this mounted the judicial decision by a New York Court in mid-2014 to make Argentina pay in full creditors who had not entered the debt restructurings of 2005 and 2010. The government’s decision not to comply with the Court’s order made Argentina fall in a new default of its debt, which created additional financial difficulties and uncertainties to an already stagnant economy. The full resolution and consequences of this complex scenario are – at the time we write these lines – still to be seen.

How was it possible for Argentina to recover so quickly and strongly from such a severe economic (ie, currency, debt and financial), social and political crisis in the early 2000s? How did it happen that the economy fell in a stagflationary trap in late 2011 after having grown so fast and without experiencing any negative external or domestic shock?

In our view, the answers to these questions are critically related to the way macroeconomic policy was conducted during this period. The strong economic recovery largely responded to the positive environment created by the macroeconomic policy regime that emerged in the immediate post-crisis. This macro-policy orientation was supported on three key pillars: (1) a stable and competitive real exchange rate (SCRER),Footnote 1 (2) twin surpluses of the current account and the fiscal balance, and (3) a large and increasing stock of international reserves at the central bank. These elements were instrumental to create a sound macroeconomic configuration and social environment that made possible a rapid recovery and later on strong and sustained economic growth. It is during this period that real wages, employment and income distribution improved the most.

Despite its success, this macro-policy orientation was gradually abandoned and replaced by a shortsighted strategy that sought to stimulate aggregate demand disregarding the impacts on the macrobalances (eg, inflation, the balance of payments and the fiscal deficit). The new orientation favored the expansion of wages and public consumption to stimulate employment and output growth, in an economy that already had signs of excess demand – GDP growing around 8% and the inflation rate around 25%. This strategy was jointly implemented with a monetary policy that implied highly negative real interest rates and used the exchange rate and public utility rates as the main nominal anchors. This cocktail resulted in a growing misalignment of key relative prices, especially a real exchange rate (RER) overvaluation and excessively low subsidized public utilities rates such as residential energy and urban transportation, which ended up affecting both the fiscal and external balances.

We devote the rest of the article to develop our argument. In the section ‘Macroeconomic performance’, we present a concise narrative of events and analyze the macroeconomic performance between 2002 and 2013. In the section ‘Macroeconomic policy’, we discuss macroeconomic policy in greater detail. We describe the main measures and policy changes during the period. We end in the section ‘Closing remarks’ with a few remarks.

MACROECONOMIC PERFORMANCE

The long agony and the collapse of the convertibility regime provoked an output contraction of 21% with respect to the peak of mid-1998. However, the economy began a strong recovery in mid-2002. Figure 1 shows the rapid recovery and sustained GDP growth after the 2001–2002 crisis, which was interrupted by the effects of the global financial crisis following the collapse of Lehman Brothers in September 2008. Between the first quarter 2002 and third quarter 2008, GDP grew at a stable annual rate of 8%. Certainly part of this process was not economic growth but recovery. However, from the first quarter 2005 – when GDP had surpassed the 1998-peak – the average annual growth rate was 7.7%. This suggests that the passage from recovery to growth did not imply a sizable deceleration. It is worth noting that it was the first time since the mid 1970s that GDP expanded so strongly and sustainably for more than four consecutive years and that it was interrupted not by an endogenous inconsistency but by a negative external shock. Moreover, given its magnitude, the effect of the negative external shock on the economy was relatively mild and short-lived.

What were the factors behind this exceptional economic performance? Certainly, the improvement of the external environment during this period – in particular, the rise of terms of trade – had a positive effect on economic performance. However, terms of trade began to improve from a local minimum reached at the beginning of 2002 and remained below the pre-Asian crisis peak until early 2004. Furthermore, the boom of terms of trade only began in 2006 when the economy had already fully recovered and was growing very fast. On the other hand, Argentina – contrarily to other countries in the region – remained largely excluded from the boom of capital inflows to emerging markets during this period. It is therefore difficult to rest on external elements to explain the favorable economic performance; one has to look elsewhere. In our assessment, the main factors are related to the macroeconomic configuration emerging from the 2001–2002 crisis.

The crisis produced a significant jump of the RER. By mid-2003, the bilateral RER against the United States had stabilized around a level 110% higher than the one prevailing before the collapse of the currency board and 45% above the average for the 1980–2001 period. The multilateral (or effective) RER was around 110% higher with respect to the pre-crisis level and 80% with respect to the 1991–2001 average. The authorities conceived that it had reached a sufficiently competitive level to support the rapid rates of recovery observed in manufactures and other tradable activities. Maintaining a SCRER became a central piece of the macroeconomic strategy and proved to be a key factor behind the economic recovery and growth between 2002 and 2008. (Figure 2)

A SCRER can foster growth via two main mechanisms. First, a competitive RER implies high tradable profitability and thus encourages investment in tradable activities.Footnote 2 The stability of the RER level reduces uncertainty, which also favors investment. Development economists have long argued that structural change and economic development are associated with the expansion of key tradable activities such as manufactures and some special tradable services (eg, software). These activities are the locus where innovation and increasing returns to scale in the form of technological spillovers and learning-by-doing externalities are more prevalent. Consequently, a macroeconomic policy that maintains a SCRER, by inducing investment in these key activities, is development-friendly and fosters growth. Historical experience – especially in Asia – and more recently econometric evidence support the claim that stable and competitive RER levels favor economic growth in developing countries.Footnote 3

A SCRER also contributes to economic growth in developing countries by promoting macroeconomic stability. Competitive RERs typically generate current account surpluses and facilitate international reserve accumulation. Current account surpluses and large stocks of foreign exchange reserves in turn operate as an insurance against international financial instability and sudden stops. Countries that face lower external financial volatility arguably tend to grow faster. Evidence suggests that SCRER, low dependence on foreign saving and large stocks of foreign exchange reserves correlate with higher growth.Footnote 4

The SCRER strategy in Argentina came along with a substantial improvement in the current account of the balance of payments. In 2001, Argentina had a deficit of 1.5% of GDP; in 2003 it turned into a surplus of 5.5% of GDP. Certainly, a good part of this improvement was because of the contraction of imports caused by the fall in domestic demand. However, Argentina maintained on average a current account surplus of 3.2% of GDP during 2005–2008, when the economy had surpassed in early 2005 its previous GDP peak.

A peculiarity of the SCRER strategy in Argentina was that it also promoted a sounder fiscal balance. The rise in the RER also facilitated an improvement of the fiscal accounts, through the introduction of taxes on primary exports. These taxes allowed the public sector to capture a portion of the redistribution of income in favor of the sectors with comparative advantages (ie, primary sector) caused by the devaluation. The primary result of the consolidated public sector went from − 2% of GDP in 2001 to 4% of GDP in 2003. This surplus reached a maximum in 2004 with 5.2% of GDP.

Thus, from the point of view of macroeconomic stability, the SCRER policy, together with the restructuring of the foreign public debt carried out in 2005 – which reduced significantly the interest payments burden – helped the economy build a solid macro configuration based on twin surpluses and a large stock of international reserves at the central bank.Footnote 5 This, together with the positive development effect on tradable output and investment, created a macroeconomic environment that fostered economic growth.

Although rapid growth was interrupted by an external shock – that is, the global financial crisis – macroeconomic performance under the SCRER strategy was not problem-free. Inflation stabilized after the crisis and reached a low of 3.7% in 2003. It then accelerated to 6.1% and 12.3% in 2004 and 2005, respectively. The acceleration of inflation during 2004–2005 was a concern for the economic team led by Finance Minister Roberto Lavagna. They actually pushed for a series of measures like the imposition of controls on capital inflows and the constitution of a fiscal stabilization fund to moderate inflationary pressures and avoid the appreciation of the exchange rate to preserve the SCRER. However these initiatives were never put in practice because Minister Lavagna left the government in late 2005.

The new economic team deemed unnecessary to instrument a comprehensive disinflation program. Instead, they implemented price ‘controls’ under the form of price agreements with leading firms. The strategy also included specific regulatory measures for certain markets, such as meat and dairy products. Its effectiveness was limited. Although inflation lowered to 9.8% in 2006, the prices of goods and services that had not been in the agreements rose about 15% on average. Furthermore, even prices within the agreements started to rise at an accelerating rate after a while. By late 2006, the persistence of inflation revealed to everyone that the price agreements and controls were becoming increasingly ineffective. Facing the acceleration of inflation, the authorities chose to start manipulating the official figures of the consumer price index (CPI) since January 2007 to publish annual inflation figures below 10%, when it actually had surpassed 20%.Footnote 6 As we discuss below, the beginning of the manipulation of the official statistics can be seen as the first of a series of serious wrong turns in the conduct of macroeconomic policy. (Figure 3)

The global financial crisis violently hit emerging market economies, especially after the collapse of Lehman Brothers in September 2008. The crisis spread out through two main channels: a trade channel and a financial channel. The sharp fall in commodities prices affected Argentina’s exports, which in turn damaged export tax revenues. However, since Argentina’s commodity exports are mostly concentrated in agricultural products whose prices suffered a lower decline than other commodities, the impact through the trade channel was not extremely severe.

The financial channel manifested itself through the behavior of private capital flows. The crisis drove investors to move their capital away from riskier to safer assets. This ‘flight to quality’ affected many emerging market economies, particularly in the last quarter of 2008. Argentina was a priori in a robust position to digest the impact of capital outflows, since it had a large stock of international reserves, and significant both current account and public sector surpluses. However, the impact of the global financial crisis combined with other factors of domestic source that exacerbated uncertainty made capital outflows intense. One of those local factors was the already mentioned falsification of official statistics. Another source of uncertainty was the conflict between the federal government and the agriculture producers over export taxes. This had happened between March and July 2008, and caused an intense capital outflow mostly driven by the domestic private sector. The nationalization of the private pension system in late 2008 was a third important source of uncertainty. Figure 4 shows how private capital outflows increased in the second half of 2007, shortly after the CPI falsification had started, and another jump in the second quarter of 2008 during the conflict with the farmers and before the fall of Lehman Brothers.

The magnitude of capital outflows during 2008–2009 was comparable to other episodes in Argentina’s economic history such as the financial crisis of the early 1980s, the Tequila effect of 1995, and the collapse of the currency board in the early 2000s. However, the destabilizing effects were comparatively much lower in the recent period. The reason lies on the substantially different macroeconomic fundamentals Argentina had in this more recent event. In the older episodes of capital outflows, the economy was in much more vulnerable conditions because of growing current account deficits, strong RER overvaluations and public sector deficits. In all previous cases, the domestic financial system had undergone through strong credit booms fed by large capital inflows before the outbreak of capital outflows. This feature made banks highly vulnerable to exchange rate risk.

The situation was completely different in the capital outflows episode of 2007–2009. The economy had been maintaining a SCRER and, as a consequence, it had a robust external configuration. The bilateral RER against the United States was 41% higher than at the end of the convertibility and the multilateral almost 100% higher. The public sector was running a surplus of 3% of GDP and the current account surplus was close to 2% of GDP. The low degree of financial deepening inherited from the financial crisis of 2001–2002 was also an important factor that helped reduce the impact of the global financial shock. While it is true that the scarcely deep financial system made almost no contribution to strengthen the recovery after the crisis, it is also true that the same characteristic turned the system less vulnerable to capital outflows.

The low degree of dollarization of banks’ (and other domestic agents’) balance sheets was another important aspect that reduced the degree of financial vulnerability. The de-dollarization of balance sheets resulted to a great extent from regulations introduced after the crisis of 2001–2002, seeking to reduce currency mismatches. New regulations forced banks to offer foreign-currency loans only to clients capable of generating resources in the same currency (eg, exporters), thereby shielding the banking system from systemic exchange rate risk.

We emphasize these factors that enhanced Argentina’s resilience to external financial shocks, because crisis prevention is one of the main objectives of a sound macroeconomic policy. This is particularly relevant regarding employment, real incomes, and income and wealth distribution; since crises often have negative impacts on all these variables. The SCRER strategy that enabled the accumulation of foreign reserves and the preservation of twin surpluses helped Argentina surf the global financial crisis without serious social or political disruptions and without jeopardizing its long-run growth prospects.

The global crisis provoked a contraction of GDP of 8.1% between the third quarter 2008 and the second quarter 2009. Despite its intensity, the recession was short-lived. The economy began to recover in the second half of 2009 and by early 2010 had reached the pre-crisis peak. The inflation rate returned to the 20%–25% range. Figure 1 shows that since this moment, the economy followed a significantly poorer performance. GDP expanded in 2010–2011 at a lower rate than before the crisis, fell in a stagnation trap after the re-election of President Cristina Fernandez de Kirchner in October 2011 and remained there until late 2014, while we write these lines.

Why did economic performance deteriorate so markedly during this period? In our evaluation, this resulted from the shift in the macroeconomic policy orientation from the SCRER strategy to another one that sought to continuously stimulate growth via demand policy (public and private consumption), regardless of the effects on inflation, the RER and the balance of payments. Some analysts like to label this new orientation as ‘demand-led’ because of the strong impulse that the government gave to wage increases and public consumption during these years. We disagree with this way of characterizing the strategy because we believe that there is no intrinsic incoherence in the formulations of demand-led growth developed by various authors. On the contrary, we think that the macroeconomic policy strategy followed especially since early 2010 embodied severe inconsistencies. We prefer to label it as ‘macroeconomic populism’. This is certainly a bold and controversial term. To avoid confusion (and hopefully controversy), we clarify in advance: we use this label to characterize an inconsistent strategy that – seeking to improve the economic conditions of the working class – engages in very expansive monetary, fiscal and incomes policies, which after an initial expansionary phase ends up generating both inflationary pressures and balance of payment problems, a generalized excess demand that is not sustainable in time and typically leads to a balance of payments crisis, devaluation and consequently a contraction of employment and real wages.Footnote 7

The shift from the SCRER strategy to macroeconomic populism was not overnight but rather the result of a sequence of wrong turns. There are, nevertheless, some key events and decisions that in our view were decisive in the shift of the macroeconomic policy orientation, which ended up affecting economic performance. The first one occurred when the SCRER strategy was at its height: the intervention of the National Institute of Statistics (INDEC, in Spanish) beginning in January 2007 with the falsification of figures of the CPI. Statistical data manipulation had various negative effects on the economy. The official CPI lost social acceptance and stopped being used as a reference for nominal wage negotiations and for the calculation of any variable in real terms. Instead the public adopted other indexes constructed by provincial bureaus of statistics or private consultancy firms.

More importantly in terms of its effect on economic performance, the underreporting of inflation implied lower adjustment of the principal of the peso-denominated bonds that were indexed to the CPI – many of them issued in the debt swap of 2005. Once it became clear that inflation underestimation had become systematic, bondholders began to get rid of these bonds and their prices to fall. The fall in bond prices extended also to dollar-denominated bonds, and therefore Argentina’s sovereign risk premium – that previously was similar to others emerging markets like Brazil – became much higher after this move (see Figure 5). Only the falsification of official statistics (and the de facto default on the indexed peso-denominated instruments it caused) can explain the otherwise strange case of a country with very robust macroeconomic fundamentals – low foreign and public debt-to-GDP ratios, rapid economic growth, twin surpluses – that suddenly begins to be isolated from the international capital markets.

The loss of credibility made the government unable to get access to the international financial markets to issue new debt. This became problematic since late 2008, when the government adopted a strongly expansionary fiscal policy. First as a counter-cyclical reaction to ameliorate the negative demand shock of the global crisis and then to sustain the new growth strategy.

It is worth mentioning in this regard, the role of subsidies to the private sector on public utilities such as residential energy and urban transportation. During 2002 the government froze public utilities rates. This was especially important in the case of energy companies that had been privatized during the 1990s, who had signed contracts establishing the dollarization of utilities rates to mitigate the exchange rate risk. The devaluation of the peso would have imposed a heavy burden on both households and firms’ budgets, thus the government decided to freeze the utilities rates and then made agreements to compensate utility companies for the raise in their production costs.

What started as an emergency measure mutated into a permanent policy. Figure 6 shows the evolution of economic subsidies as a share of GDP and how they kept growing. Between 2002 and 2007, during Nestor Kirchner’s administration and arguably the period in which it was important to improve the deeply deteriorated social conditions, subsidies to the private sector averaged less than 0.9% of GDP. However, since 2008 its burden raised non-stop and ended up accounting for close to 5% of GDP in 2013. In a nutshell, what happened was that the production costs of private providers – especially residential energy and transportation in the Buenos Aires urban area – kept rising together with wage and price inflation, while utilities rates remained virtually frozen. The increasing gap between cost and revenues was filled with subsidies. In other words, this was a sustained and increasing income transfer, which benefited to a great extent the urban middle and upper middle-class households, who could pay transportation tickets and electricity and gas bills between 70% and 80% cheaper than households in the neighbor countries (see Guadagni, 2012).

Another consequence of this incomes policy was the deterioration of the trade balance of energy products. Given the weak incentives to invest in exploration and production, the domestic supply of oil and gas tended to decline. On the other hand, the demand kept rising because of both the growth of real incomes and production, and the decline in the relative price of energy. The consequence was a sustained contraction of the trade balance of energy products. Figure 6 shows how its trade balance fell from a surplus close to 3.5% of GDP to a deficit of 1% of GDP in 2013. It is clear from Figure 6 that the incomes policy of subsidizing private sector’s expenditure in energy and transportation was a key factor behind the shift from twin surpluses to twin deficits experienced during this period.

The increasing financial needs generated by the expansionary fiscal and incomes policies in a context of no access to foreign financing put increasing pressure on monetary policy and led to another key event that helped shape the new macroeconomic regime: the reform of the Central Bank Act (CBA) in March 2012. Previously, in January 2010, the government had forced the dismissal of the Governor of the central bank and appointed a new one. These events were instrumental in the reformulation of macroeconomic policy, making fiscal and incomes policies dominant over monetary and exchange rate policies.

These events and the specific way they affected in macroeconomic policy are discussed in the section ‘Macroeconomic policy’. We focus here on their consequence on the macroeconomic performance. Simply put, during the 2010–2011 biennium – the initial expansive phase of the populist strategy – monetary, fiscal and incomes policies adopted a very strong expansionary pace, while exchange rate policy operated as a nominal anchor to contain the inflationary pressures. Consumer prices grew at an average annual rate of 23%, private sector wages at 27% and the nominal exchange rate at only 5.5%. These nominal variations implied an annual growth rate of real wages around 3.5% and one of 20.5% for wages measured in US dollars. The flipside of the latter was a substantial RER appreciation. By the end of 2011, the level of the bilateral RER against the United States was about the same as the one prevailing before the 2001 crisis; a level that was no doubt overvalued. The multilateral RER was about 50% higher than at the end of the currency board, but this was because of the fact that some Latin American trade partners – most notably Brazil – had very overvalued currencies themselves.

The stimulus on aggregate demand made GDP expand during this 2-year period but the process of RER appreciation put pressure on the international reserves of the central bank during the second half of 2011. To avoid the seemingly unavoidable correction of the RER, the government imposed controls on the FX transactions since November 2011. As explained in the section ‘Macroeconomy policy’, controls prevented a sudden depletion of FX reserves but aggravated the disequilibrium and put the economy in a stagflationary spiral, in which it remains while this article goes to press.

Table 1 presents a series of performance indicators for both the SCRER and populist periods. For convenience, we use yearly data and consequently encapsulate the SCRER period in the 6 years of 2003–2008. For the second one, we use the 4-year period of 2010–2013.

The contrast in terms of economic performance is evident. In the 2003–2008 period, the economy grew at an average rate of 7.8%, in contrast to 2.5% during the second one. Industrial employment and real wages also grew substantially more in the first period compared with the second one. Furthermore, private sector employment – not shown in Table 1 – remained virtually stagnant during the second period, and total employment mostly grew because of public employment. Income inequality – measured through the Gini coefficient – improved the most during the first period as well. Table 1 also shows that the robust macroeconomic configuration consisting of a competitive RER, low (although accelerating) inflation and twin surpluses during the 2003–2008 period switched to another one with a substantially more appreciated RER, higher inflation rate and lower surpluses, which ended up turning into twin deficits in 2013. These outcomes happened despite the fact that external conditions – measured via terms of trade and the US Federal Reserve (FED) overnight interest rate – improved significantly in the second period.

MACROECONOMIC POLICY

The convertibility crisis not only caused a severe contraction on economic activity, employment and incomes, but also affected the balance sheets of domestic agents, the contracting and payments systems and several economic institutions. The resolution of the crisis required a number of emergency measures; most of them carried out during 2002 and 2003 under the provisional administration of President Eduardo Duhalde. To avoid the collapse of the financial system, private deposits were converted into public bonds and banks’ dollarized assets and liabilities converted into pesos. To control the impact of devaluation on real incomes, public utilities rates that were dollarized by contract were also converted into pesos. Another important measure was the imposition of taxes on primary exports (eg, soy bean, wheat, meat and oil) to curb the pass-through of devaluation to domestic prices. The revenues captured with these taxes helped finance public spending; in particular, an income-transfer program targeting unemployed heads of households, reaching almost 2 million poor families.Footnote 8

The crisis also forced a rapid modification of several norms and institutions that had governed Argentina’s macroeconomic behavior during the 1990s. CBA was one of them. The central bank had been declared an autarchic institution ruled by its CBA in 1992. It established central bank’s independence and the main objective of price stability. In 1991, the congress had passed a law setting the full convertibility of domestic currency at a fixed parity of one peso per US dollar, and also obliging the central bank to fully back the monetary base with foreign exchange reserves at the given parity. Thus, the ‘convertibility regime’ essentially turned the central bank into a currency board. In line with the mandates of this law, the CBA established very restrictive limits for liquidity assistance to commercial banks and the Treasury. Although the CBA had been modified to give the central bank more degrees of freedom to deal with situations of systemic illiquidity after the banking crisis of 1995 – which had been triggered by the contagion effect of the Mexican crisis – its ability to lend remained very constrained.

The collapse of the convertibility regime demanded a significant modification of the norms regulating the functioning of the central bank.Footnote 9 Since the currency board had been eliminated, the CBA was modified in order to establish the instruments and duties of the central bank to conduct monetary policy. Several important modifications were introduced, however central bank’s independence and price stability as the main goal of monetary policy remained untouched.

The new monetary regime emerging from these modifications was similar – at least formally – to those implemented in other Latin American countries consisting on the free floating of the exchange rate and an inflation targeting policy rule. The modified CBA established that in the conduct of monetary policy the authorities had to present a Monetary Program at the beginning of each year, in which they should announce an inflation target and a projection of the evolution of monetary aggregates. It also established a mandatory quarterly assessment – latter called the Inflation Report – with a follow-up of the targets and projections in which the authorities evaluate their actions and explain the reasons of any deviation from the original program. Failing to meet this transparency norm could be cause of removal of the members of the Board.

The CBA was also modified to give the central bank greater degrees of freedom in its ability to provide short-term credit to illiquid commercial banks. This was a much-needed instrument during the crisis because most banks were illiquid and under intense financial stress. The ability to lend to the Treasury was also widened. Initially (January 2002), short-term lending to the public sector was established with a limit up to 10% of yearly Federal government’s revenues. In August 2003, given the need to meet the debt services with multilateral financial institutions in a context of credit rationing because of the default, the limit was relaxed by adding an extra up to 12% of the monetary base.

The first Monetary Program was presented in November 2002, in which the authorities announced the objectives and policy measures for 2003. At that moment, the central bank was stabilizing the exchange rate – which had jumped from 1 AR$/US$ in December 2001 to almost 4 AR$/US$ in July 2002 – and normalizing the money market by reducing the policy interest rate from a peak of 115% reached in July 2002. Economic activity was recovering and with it the demand for money. The Program established the objective of stabilizing inflation and a quantitative target for the monetary base, which would be achieved through the combination of interventions in the foreign exchange market and sterilization operations in the money market through central bank short-term debt instruments (called Nobac and Lebac). The authorities did not announce an inflation target. Thus, instead of implementing a standard inflation-targeting regime – with the announcement of an inflation-target and the use of a policy interest rate as the main instrument of monetary policy – the authorities opted for a more eclectic regime based on the management of monetary aggregates, FX intervention and sterilization operations. This choice was justified by the fact that the economy was still absorbing the effects of the crisis and domestic financial markets had shrunk significantly. Thus, the monetary transmission mechanisms of the interest rate were thought to be highly uncertain and weak.

From 2003 on, monetary targets were announced every year in the presentation of Monetary Programs before the Congress, where the Governor of the central bank committed to maintain monetary aggregates within a certain range. Given the uncertainty surrounding the evolution of money demand and the effects of monetary policy, these ranges were sufficiently broad. The authorities had the intention – expressed in several Monetary Programs and Inflation Reports between 2003 and 2007 – to migrate gradually to a standard inflation-targeting regime as the economy and the financial system normalized. This, however, never happened.

From mid-2002 to mid-2003, the peso followed a sustained appreciating trend from 4 to 3 pesos per dollar. It was a government’s decision to stop this process. The effects of RER competitiveness on economic activity, employment and external and fiscal accounts were demonstrating to be highly favorable. Although the RER was not part of the policy objectives established in the CBA, maintaining a SCRER was adopted as a de facto target of macroeconomic policy. The authorities never mentioned a specific target, but interventions in the foreign exchange market by both the central bank and the Treasury sought to keep the multilateral RER stable around the level of late 2003, which was clearly very competitive (about 110% higher than the one prevailing before the collapse of the currency board). Publicly, the central bank justified its FX intervention not in terms of a specific SCRER target, but in terms of accumulation of international reserves to preserve financial stability in a world of volatile capital movements (eg, Redrado et al., 2006).

Between 2003 and 2006, the authorities managed to maintain the SCRER and inflation rates relatively low although accelerating. The two policy objectives were largely addressed with two instruments. Monetary policy was conducted through the management of monetary aggregates, which were set sufficiently broad to cope with the uncertain evolution of the demand for money in an economy that was recovering from a severe financial crisis. Interestingly, the upper levels of the bands for the quantitative targets established in every Monetary Program resulted systematically lower than the monetary expansion arising from the interventions in the FX market required to accumulate international reserves and maintain the SCRER. Thus, from the very beginning, monetary policy had to deal with two ‘conflicting’ forces: monetary expansion due to the intervention in the FX market that tended to be significantly larger than the quantitative targets announced in the Monetary Programs.

The tension arising from the two policy objectives can be observed in Table 2, which shows the sources of variation of the monetary base, the quantitative target used between 2003 and 2005.Footnote 10 The amount of monetary base issued because of the intervention in the FX market (ie first column in Table 2) exceeded the actual expansion of the monetary base to accomplish the quantitative targets (ie, second column), generating an ‘excess supply’ of monetary base (ie, third column) that had to be absorbed.

Table 2 shows that the sterilization operations played a key role at absorbing the ‘excess supply’ of monetary base. Between 2003 and 2006, 42% of the ‘excess supply’ was absorbed through these operations. Other mechanisms of absorption were also relevant. First, as liquidity recovered, banks started to cancel the credit they had received from central bank during the financial crisis in 2001–2002. These operations worked as a source of monetary base contraction. By early 2006, most banks had canceled their debts with the central bank.

The Treasury also helped absorb the ‘excess’ of monetary expansion by purchasing central bank’s international reserves, which were used to meet the interest payments and amortizations of debt with the multilateral financial institutions. The Treasury and other official agencies also accumulated part of the fiscal surplus in foreign currency and thus intervened directly in the FX market to alleviate central bank’s management of the ‘conflicting’ objectives. These operations started in late 2002 and gradually expanded afterwards, thus becoming an important policy instrument (ie, last column).

Since 2006, monetary policy stopped targeting the monetary base and started to set targets on M2. The goal was to migrate to a broader target with higher correlation with domestic prices. The migration also helped relax the conflicting management of exchange rate and monetary policies. The central bank was facing increasing difficulties to accomplish the monetary base targets in a context of sustained increase of the demand for domestic assets (ie, sustained excess supply of US dollars in the FX market; column 1). As Table 2 shows, the ‘excess’ of monetary expansion had risen non-stop since 2003. After the debt restructuring of 2005, the excess supply was also fed by the net capital inflows. The use of M2 as a target gave the authorities greater flexibility to conduct the two-target policy, allowing for both a larger intervention in the FX market and a larger monetary expansion.

It is commonly argued that sterilized foreign exchange interventions – like those carried out by the central bank during this period – are not sustainable in time because of the rising costs of issuing short-term securities. However, if the amount of interest payments that these instruments generate is equal or lower than the amount of yields obtained from the international reserves, sterilized foreign interventions can be sustainable.Footnote 11 This was the case during the SCRER period. The evolution of the central bank balance showed no signs of unsustainability related to the sterilization policy.

One may also wonder whether the management of monetary and exchange rate policy focusing on two targets was one of the reasons behind the observed acceleration of inflation during the SCRER period as discussed in the section ‘Macroeconomic performance’. In our assessment, inflation accelerated not because of inconsistencies in the management of monetary and exchange rate policies, but because of the lack of coordination between them and fiscal and, especially, wage policies.

Fiscal policy had a contractionary bias between 2002 and 2004. Figure 7 shows that the contractionary impulse during this period was significant: between late 2001 and mid-2004, the primary balance increased by more than 3 points of GDP. Since mid-2004 and until the onset of the global financial crisis, fiscal policy followed a rather neutral stance if measured by the change of the primary fiscal balance, which remained around 3% of GDP. Thus, fiscal policy does not seem to have operated as a main factor behind the acceleration of inflation.

Wage policy, on the contrary, was strongly expansionary and inflationary almost without interruption since early 2003. In another study (Frenkel et al., 2015), we find that, as from 2003, the rate of growth of nominal wages was always higher than past inflation plus the rate of growth of labor productivity, implying a sustained rising trend in unit labor costs. Up to the end of 2004, mark-ups contracted somewhat, but afterwards they tended to remain relatively stable. Consequently, the sustained rising trend of unit labor costs translated into sustained inflationary pressures. The inflationary effects of aggregate demand, on the other hand, manifested principally through non-tradable food prices (meats, fruits and vegetables), which operated as accelerating/decelerating factors on the inflation dynamics. Other significant inflationary factors were the increase in US dollar prices of commodity exports and imported manufacturing inputs; the latter were largely caused by the currency appreciation in real terms of Argentina’s trade partners experienced during the 2004–2008 period; particularly in Brazil.

The acceleration of inflation posed a dilemma for macroeconomic policy in 2007. During 2003–2006, the government had benefited from a sort of ‘divine coincidence’ in which the central bank managed to maintain a SCRER and accumulate international reserves through sterilized foreign-exchange interventions keeping the nominal exchange rate stable around 3 pesos per dollar. Exchange rate stability, in turn, worked as a nominal anchor at least for tradable prices. Once inflation accelerated, the monetary authorities found increasingly difficult to target both the nominal and the real exchange rate simultaneously. There was now a trade-off. Keeping the SCRER would require to devalue the peso at a pace somewhat similar to the inflation rate, but this would imply to stop using the exchange rate as a nominal anchor. Keeping the nominal exchange rate stable to provide an anchor for inflation, on the contrary, would imply to let the RER appreciate and give up to the SCRER goal.

For some time, the authorities handled this conflict somewhat ambiguously. Between early 2007 and the collapse of Lehman in September 2008, they kept the exchange rate stable around 3.10 pesos per dollar in order to provide a nominal anchor for inflation. The consequence was a significant appreciation of the RER. In 2009, the central bank sought to reverse this outcome and guided the exchange rate upwards – from about 3.05 to 3.85 pesos per dollar – to reach a multilateral RER level broadly similar to the one prevailing in early 2008. Since early 2010, the ambiguity vanished and the central bank adopted the exchange rate as a nominal anchor.

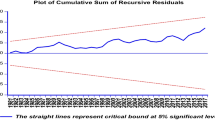

The definitive abandonment of a SCRER as a target of monetary and exchange rate policies since early 2010 coincides with the intensification of the expansionary stance of fiscal policy. This had adopted a strong expansionary bias during the global financial crisis. The move was a standard counter-cyclical response to offset the impact of the negative demand shock caused by the fall in the terms of trade and the contraction of global demand. However, when the economy reached the pre-crisis peak in early 2010, the expansionary fiscal bias was not reverted but maintained. The size of fiscal impulse to aggregate demand can be approximated by the reduction of the primary fiscal surplus. Figure 7 depicts the contraction of the primary fiscal surplus that began in late 2008 and continued after the recovery in 2010. In mid-2012, primary fiscal balance turned negative for the first time during the post-convertibility period. The primary fiscal deficit kept growing ever since without any sign of reversion by the time we write these lines.

The change in the orientation of fiscal policy had important implications on the conduct of macroeconomic policy, especially regarding the central bank. As mentioned above, two events were especially relevant. In December 2005, Nestor Kirchner had issued a Presidential Decree establishing ‘freely available reserves’ as the international reserves at the central bank in excess of the stock required to fully back the monetary base at the existing exchange rate.Footnote 12 Because Argentina had just restructured its foreign debt and had remained rationed from the international financial markets since the default of 2001, ‘freely available reserves’ would serve to pay debt obligations with multilateral credit organizations while the government regained access to the international capital markets. Right after the decree was issued, the government canceled the outstanding debt with the IMF for a total of US$ 10 billion.

The intervention of INDEC pushed the government away form the international capital markets and forced it to look for alternative sources of finance to serve its debt in foreign currency. In December 2009, Cristina Kirchner passed a new decree extending the use of ‘freely available reserves’ to cancel all public debt obligations in foreign currency, thus adding the amortization of debt with private creditors to those with multilateral organizations. The Governor of the Central Bank, Martín Redrado, refused to transfer the required funds arguing that this affected central bank’s independence. In a tense political environment and following the established procedures for a removal, President Cristina Kirchner dismissed Redrado and replaced him with Mercedes Marcó del Pont, who allowed the use of central bank’s ‘freely available reserves’ to cancel public debt services.

A second important step in the subordination of central bank to fiscal and incomes policies occurred with a new modification of CBA in March 2012. The change of the CBA was thorough. The objective of monetary policy shifted from price stability to ‘promote – within the framework of its powers and the policies set by the National Government – monetary and financial stability, employment, and economic development with social equality’. This broad and vague mandate turned authorities virtually unaccountable and increased their space for discretion in the conduct of monetary policy. The requirements to announce an inflation target and monetary projections in the Monetary Program, their quarterly follow-up and justification of potential deviations from it were all eliminated from the CBA.

Probably more relevant in terms of macroeconomic policy was the significant increase of central bank’s ability to lend to the Treasury. In early 2012, the government was using all the short-term financing allowed by the CBA and was close to run a primary fiscal deficit. Under the new CBA the limit of short-term lending in pesos was raised by another 10% of Federal government’s yearly resources. Finally, the new CBA also entitled the Board of the central bank to discretionally determine the level of ‘freely available reserves’ and therefore to transfer international reserves to the Treasury to cancel debt services in foreign currency virtually without limit.

Figure 8 shows the evolution of both the actual and the limit established in the CBA on the short-term financing in pesos by the central bank as a share of yearly Federal government’s revenues. The limit on short-term financing in pesos was raised twice during the whole post-convertibility period: once in August 2003 and a second one with the CBA passed in March 2012. Figure 8 shows that during the SCRER period financing averaged 11.1% of yearly government revenues. Following the global financial crisis, it increased to an average of 13% and approached to the limit right before the modification of the CBA in March 2012. Since this moment, short-term financing grew virtually non-stop and approached again the new limit above 25% of yearly revenues by the end of 2013.

It is important to notice that while the financing to cancel foreign debt services via the use of ‘freely available reserves’ is neutral in terms of money creation, short-term financing in pesos is not. Figure 9 shows the source of monetary base (MB) creation and gives a sense of the monetary effects of fiscal policy. The figure illustrates eloquently the periodization discussed in the article. The period during which macroeconomic policy targeted a SCRER is the one in which the central bank intervened systematically in the foreign exchange market to keep the exchange rate at a competitive level, at the cost of creating monetary base excessively (ie, the FX line was always well above the MB line). To attain the monetary target announced in the monetary programs, the central bank intervened in the money market with sterilization operations and thus partially neutralized the monetary effect of the FX intervention. All along the SCRER regime period, the government operated as source of money absorption (ie, the Gov line always remained below zero): fiscal surpluses were funneled to buy international reserves to pay debt services in foreign currency and thus helped neutralize the monetary impact of FX intervention.

The global financial crisis was a hiatus in which the private excess supply of FX turned into an excess demand. The central bank began to intervene in the FX market to sell international reserves, operating as a source of monetary contraction. To avoid excessive demonetization, sterilization operations were reversed during this period. It is easy to observe how expansionary fiscal policy starting in 2009 switched the role of the government in the money market. In early 2010, the government’s needs of financing by the central bank began to operate as a source of money creation. By late 2011, it became the main one, and since mid-2013, its volume was even larger than the variation of the monetary base itself.

This rapid pace of monetary creation associated with the expansionary fiscal policy turned monetary policy also in an expansionary force. Figure 10 shows the evolution of the ex-ante real interest rate of the central bank letters of year of maturity (LEBACs), a policy interest rate.Footnote 13 It is clear that the central bank pursued a policy of low real interest rates (close to zero) until early, 2007, when inflation accelerated. Because it took some time to get alternative estimates of inflation after the government began adulterating the CPI statistics, monetary authorities reacted slowly to the new environment. Since late 2007, however, the policy interest rate gradually started to rise and by the end of 2008 caught up with inflation. Capital outflows, first because of the conflict with agricultural producers and later on to the contagion of the subprime crisis were key determinants of the upward move of the interest rates. From early 2010 onwards, with the new authorities at the central bank, the ex-ante real Lebac interest rate had a markedly expansive bias; it remained around negative 7%–8% until the discrete devaluation of January 2014.

It is interesting to note, however, that negative real interest rates of such magnitudes did not trigger a sizable run away from domestic assets. This may look like a puzzle, but in a country in which the private sector has a preference toward foreign assets and is used to measure returns in terms of US dollar, domestic assets like bank deposits offered attractive returns for several years. Figure 10 also shows the returns on two other investments. The line Badlar U$ is the ex-ante return measured in US dollars of term deposits in domestic banks.Footnote 14 The remaining line is proxy of the return of an Argentine government bond issued in dollars – the interest rate of US Treasury of 10 years plus Argentina’s risk premium measured by the EMBI_AR – which illustrates the return of an investment of more sophisticated investors who mitigate the exchange rate risk but are willing to take Argentine risk. Figure 10 shows that the return on a bank deposit (ie, blue line) or a domestic bond (ie, red line) offered yields above 5% per year in US dollars, even when the real interest rate was very negative. The yields of bonds and bank deposits were very similar until September 2008. Since then and until October 2011, the yield of domestic bonds tended to be systematically – although moderately – higher than a bank deposit. After the imposition of controls in the FX market, the yield of term deposit measured in US dollar fell continuously and began to be negative in early 2013.

The key to understanding this unusual environment of highly negative real domestic interest rates and high domestic returns if measured in US dollar is that nominal domestic interest rates were significantly lower than the inflation rate but sufficiently higher than the pace of exchange rate depreciation. This setting occurred for a long period, but with special intensity between early 2010 and late 2011; the expansionary phase of the populist strategy. The flipside of this configuration was a persistent and significant appreciation of the real exchange rate. A continuous RER appreciation is obviously non-sustainable and resembles the story in Krugman (1979), at some point holders of domestic-currency-denominated assets would switch their portfolios in favor of foreign-currency-denominated assets. If, in such scenario, the central bank attempts to control the exchange rate, its international reserves would be attacked. In Argentina’s recent episode, the element that coordinated the run against central bank international reserves was the Presidential election of October 2011. It was in late 2011 when the yield in US dollar of a domestic bank deposit fell dramatically and a few months later turned negative. Its yield did not recover because the central bank kept interest rates low to maintain the stimulus on aggregate demand, but this could only be done thanks to the imposition of strict controls on the FX market as explained below.

Cristina Fernandez won re-election in a landslide victory, with 54% of the votes, retaining the top office for a second term; the third one in a row for the Kirchner family. In the months before the elections, there was a generalized perception that the economy was turning uncompetitive, that the RER was appreciating at a rapid pace and that sooner than later the exchange rate would have to be corrected upwards (ie, devaluation). Because devaluation is unpopular, people believed that the authorities would wait until the elections had passed. Trying to anticipate this move, the public ran against the international reserves of the central bank, which lost 6 billion dollars in the process.

Once Cristina Kirchner was re-elected, the government decided not to devalue the peso. The excess demand for foreign currency continued and the central bank kept loosing reserves. The government could have tried to correct the excess demand for foreign exchange with a standard balance of payments stabilization program; a mix of devaluation and interest rate hikes. This option would have surely accelerated inflation, reduced real wages and contracted the level of activity and employment. In other words, the upward correction of the RER would have implied a downward adjustment of real wages and a contraction of employment. The government considered this option unpopular despite the fact that they had won the election and had a large political capital. They decided instead to curb the excess demand of foreign currency by imposing controls on imports, the transfer of profits from foreign investment and the acquisition of foreign currencies for saving motives and tourism.

Many Latin American countries experienced with this kind of controls in the past. A lesson learned from these experiences is that controls can be very useful when implemented in conditions of sound macroeconomic fundamentals (eg, the RER is not misaligned and fiscal and external balances follow sustainable paths). However, experiences have also shown that controls not only fail to correct macroeconomic imbalances, but also tend to exacerbate them. The prototypical sequence is that controls end up debilitating or destroying existing markets and stimulating the creation of new ones, black markets. Black markets undermine transactions and shorten planning horizons and thus have negative effects on output and employment. This is typically the beginning of the contractive phase of a populist cycle of this kind. Historical experiences also revealed that the black market exchange premium tends to increase the tighter controls are and the stronger the imbalances are. The widening of the premium is especially problematic because it generates incentives to reduce the supply of and increase the demand for foreign exchange in the official market. Exporters have incentives to postpone and under-invoice their proceeds and importers to anticipate and over-invoice their purchases. Firms and banks also try to have access to the official market to cancel foreign debts up-front. The proliferation of this kind of strategies creates a feedback loop that exacerbates the excess demand in the official market, the fall of central bank’s reserves, and the rise of the black market premium. At some point, when international reserves reach a critical level, the central bank has no choice but to devalue. This severely intensifies the contractionary phase of the populist cycle.

These stylized trends were observed in Argentina since controls were imposed in late 2011. The black market exchange premium followed an upward trend and central bank’s international reserves fell non-stop. In November 2013, after a poor mid-term election, Cristina Fernandez removed Marcó del Pont from the central bank and put in charge a new economic team. International reserves were $33 billion and the exchange rate had reached 6 pesos per dollar. The situation had severely worsened since July 2011, before the presidential election, when the stock of international reserves at the central bank was $52 billion and the exchange rate 4.1 pesos per dollar. The new economic team accelerated the rate of depreciation, but since interest rate were substantially lower than expected devaluation, international reserves at the central bank kept falling. In January 2014, when reserves reached a low of $28 billion, the central bank devalued the domestic currency from 6.7 to 8 pesos per dollar and raised the reference interest rate from 15% to 29%.

At the moment we write these lines, the economy is absorbing the impacts of these measures. Evidence suggests that the currency crisis has accelerated inflation – which is estimated to be around 40% for most analysts – and that output and employment is contracting.

CLOSING REMARKS

We assess the complete dissolution of the macroeconomic policy scheme that prevailed broadly between mid-2002 and mid-2008 as a loss of a big opportunity to set Argentina on a sustainable and inclusive economic growth path. The SCRER strategy resulted in high growth rates for output, employment and productivity and also relaxed both the external and fiscal balances. We believe that the maintenance of this macroeconomic configuration would have allowed a sustained non-inflationary increase in real wages, which combined with the increase in private sector employment, would have tended to reduce income inequality. All these trends were observed in the first period under analysis.

The SCRER strategy was not problem-free. Together with the positive trends that we have highlighted, inflation was accelerating. Inflationary pressures should have been tacked with a comprehensive anti-inflationary program. Such a program would have required a tighter management of aggregate demand and a reshape of the macroeconomic policy scheme. Considering that monetary policy was partly constrained by the objective of preserving a SCRER, a comprehensive disinflation program would have posed higher weight on fiscal policy to affect the pace of aggregate spending than in a standard inflation-targeting framework. This would have implied to switch the bias of this policy from neutral/expansive to contractive. The program would have also required a more active incomes policy aiming to coordinate the pace of wage increases with productivity growth. It would have also required a reduction of energy and transportation subsidies, especially those favoring middle and upper middle-class households. Such a reorientation of macroeconomic policy – including the adoption of an explicit one-digit inflation target – should have been announced publicly to coordinate private sector’s expectations toward decelerating inflation rates.Footnote 15

Whether such a comprehensive approach would have been successful at stabilizing inflation around a one-digit rate and simultaneously maintain a SCRER and its positive effects on growth is an open question. Nothing guarantees that its full implementation would have delivered such positive outcomes. What we do know is that the government did not try this alternative and instead headed into a completely opposite direction and drove the country to a stagflationary trap, whose complete negative effects on output, employment, incomes and income distribution are still to be seen.

Notes

We follow the Latin American tradition of defining the exchange rate as the domestic price of a foreign currency. Consequently, a rise (fall) of both the nominal and the real exchange rate implies a nominal or real depreciation (appreciation).

By ‘competitive’ RER we mean one that is above its equilibrium level. Equilibrium RER is a concept that generates no few confusions and debates. For simplicity, we define it here as the one at which the economy is at macroeconomic equilibrium (ie, full employment with low and non-accelerating inflation and external balance). Conceptually, a developing economy has a ‘competitive’ RER level when the modern (or non-traditional) tradable sector reaches a risk-adjusted profit rate that is at least equal to that of the same sector in a developed economy. See Rapetti (2013a) for further details.

See Rodrik (2008), Razmi et al. (2012) and Rapetti et al. (2012), among others.

See Polterovich and Popov and Polterovich (2002), Levy-Yeyati and Sturzenegger (2007) and Prasad et al. (2007).

A debt restructuring was carried out between January and May 2005. About 76% of the defaulted debt involving 82 billion dollars was exchanged for new bonds. The debt swap implied a nominal haircut of 40% of Argentina’s GDP. See Damill et al. (2010) for an analysis and description of the debt restructuring process. A second debt swap occurred in 2010, in which another 17% accepted a similar offer to the one of 2005.

The manipulation of the CPI affected the elaboration of other statistics, in particular real and nominal GDP and poverty and extreme poverty rates. In all figures and tables in this article that involve variables affected since January 2007, we use the CPI calculated by ECOLATINA, a private consultancy firm, and the real GDP estimated by ARKLEMS+LAND, a research center at the University of Buenos Aires.

Canitrot (1975) is a seminal contribution to the study of macroeconomics populism. Dornbusch and Edwards (1991) and Bresser-Pereira and Dall’Acqua (1991) are other relevant contributions to this literature.

A more comprehensive description and analysis of the measures taken during the emergency period can be found in Frenkel and Rapetti (2006).

Table A1 in the Appendix summarizes the main modifications of the legal and institutional characteristics of central banking in Argentina between 2002 and 2013.

Frenkel and Rapetti (2008) analyze in greater detail monetary and exchange rate policies during the 2002–2007 period.

See Frenkel (2007) for the conditions for sterilized foreign interventions to be sustainable.

In a managed-floating exchange rate regime there is no need to establish any specific relation between the monetary base and international reserves. However, since Argentina had lived more than a decade with a currency board demanding a stock of international reserves at least equal to the monetary base at the official exchange rate, the authorities believed that the decision of maintaining enough reserves to back the monetary base would generate confidence in the private sector and support their demand for money.

We calculate the ex-ante real interest rate as the nominal interest rate in period t minus the yearly inflation rate between t−1 and t. We assume adaptive expectations because of the lack of a reliable measure of private sector’s expected inflation since the manipulation of official statistics.

We keep assuming adaptive expectations and calculate Badlar U$ as the peso interest rate of time deposits of 1 million pesos or above in period t discounted by the variation of the nominal exchange rate between t−1 and t.

See Frenkel (2008) and Rapetti (2013b) on the theoretical aspects of macroeconomic policy coordination in a SCRER regime.

References

Bresser-Pereira, LC and Dall’Acqua, F . 1991: Economic populism versus keynes: Reinterpreting budget deficit in Latin America. Journal of Post Keynesian Economics 14 (1): 29–38.

Canitrot, A . 1975: La experiencia populista de redistribución de ingresos. Desarrollo Económico 15 (59): 331–351.

Damill, M, Frenkel, R and Rapetti, M . 2010: The Argentinian debt: History, default, and restructuring. In: Herman, B, Gaviria, JAO and Spiegel, S (eds). Overcoming Developing Country Debt Crises. Oxford University Press: Oxford, UK, pp. 179–230.

Dornbusch, R and Edwards, S . 1991: The macroeconomics of populism in Latin America. University of Chicago Press: Chicago.

Frenkel, R . 2007: The sustainability of monetary: Sterilization policies. Cepal Review 93: 29–36.

Frenkel, R . 2008: The competitive real exchange-rate regime, inflation and monetary policy. Cepal Review 96: 191–201.

Frenkel, R and Rapetti, M . 2006: Argentina’s monetary and exchange rate policies after the convertibility regime collapse. Political Economy Research Institute (PERI), University of Massachusetts: Amherst, MA.

Frenkel, R and Rapetti, M . 2008: Five years of competitive and stable real exchange rate in Argentina, 2002–2007. International Review of Applied Economics 22 (2): 215–226.

Frenkel, R, Rapetti, M and Sigaut, L . 2015: Dinámica inflacionaria en Argentina 2002–2013. Centro de Estudio de Estado y Sociedad (CEDES) (mimeo). Buenos Aires, Argentina.

Guadagni, A . 2012: Presente y Futuro del Gas en la Argentina, economic and research forecasts. Econométrica: Buenos Aires.

Krugman, P . 1979: A model of balance-of-payments crises. Journal of money, credit and banking 11 (3): 311–325.

Levy-Yeyati, E and Sturzenegger, F . 2007: Fear of floating in reverse: Exchange rate policy in the 2000s. unpublished. World Bank: Washington DC.

Popov, V and Polterovich, V . 2002: Accumulation of foreign exchange reserves and long term growth. New Economic School, Moscow, Russia, unpublished paper.

Prasad, E, Rajan, R and Subramanian, A . 2007: Foreign capital and economic growth. Brookings Papers on Economic Activity (1): 153–230.

Rapetti, M . 2013a: The real exchange rate and economic growth: Some observations on the possible channels. Working Paper 2013-11, Department of Economics, University of Massachusetts: Amherst.

Rapetti, M . 2013b: Macroeconomic policy coordination in a competitive real exchange rate strategy for development. Journal of Globalization and Development 3 (2): 1–31.

Rapetti, M, Skott, P and Razmi, A . 2012: The real exchange rate and economic growth: Are developing countries different? International Review of Applied Economics 26 (6): 735–753.

Razmi, A, Rapetti, M and Skott, P . 2012: The real exchange rate and economic development. Structural Change and Economic Dynamics 23 (2): 151–169.

Redrado, M, Carrera, J, Bastourre, D and Ibarlucia, J . 2006: The economic policy of foreign reserve accumulation: New international evidence. Central Bank of Argentina, Economic Research Department: Buenos Aires, Argentina.

Rodrik, D . 2008: The real exchange rate and economic growth. Brookings Papers on Economic Activity (2): 365–412.

Acknowledgements

The authors are grateful to Ramiro Albrieu and Oscar Cetrángolo for their helpful comments and to Diego Friedheim for his assistance.

Author information

Authors and Affiliations

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Damill, M., Frenkel, R. & Rapetti, M. Macroeconomic Policy in Argentina During 2002–2013. Comp Econ Stud 57, 369–400 (2015). https://doi.org/10.1057/ces.2015.3

Published:

Issue Date:

DOI: https://doi.org/10.1057/ces.2015.3